BookTrib’s Bites: Four Fascinating Fall Reads

(NewsUSA) -

-  Deena Undone by Debra Every

Deena Undone by Debra Every

A terrifying nightmare sets off a series of attacks on Deena Bartlett's five senses, and her eighty-year-old Aunt Agatha is responsible. But the old woman is not alone. She's made a monstrous bargain with the Sensu, a malevolent entity whose stock in trade is attacking a person's five senses, one by one. It has promised Agatha health in return for the killing of her niece.

Deena has remained loyal to her bitter aunt for years. But Agatha is dying and her insults will soon end... until a string of inexplicable incidents. A sound so piercing Deena's nose bleeds. A smell so vile her breathing suffocates. And after each attack her aunt's health improves. With mounting dread, Deena discovers her aunt’s bargain, and when the Sensu thrusts her into its terrifying realm, she must battle not only the power of her aunt's long-held secrets but her own guilt. Purchase at https://bit.ly/3THZfMX.

The Burning Years: Until This Last Quartet: Book 1 by Felicity Harley

The Burning Years: Until This Last Quartet: Book 1 by Felicity Harley

In this first book in a series, it’s the year, 2060. Sophie, a top female scientist, dismantles the government weather modification program and steals the male and female trans-humans who hold the promise of extended life.

While the remaining inhabitants of Earth are forced to design new underground habitats in order to survive a harsh, overheated world, Captain Rachel Chen, takes the worldship Persephone to Proxima Centauri, hoping that this new star system will provide a refuge for the survivors of the human race.

One Amazon reviewer calls the book “captivating and fast-paced, covering important issues facing our planet through a very engaging story. The author provides a wealth of scientific information very creatively, easily weaving it in as part of the suspense and plot of this story.” Purchase at https://bit.ly/4cMA9Ev.

Don’t Judge a Book by Its Cover by Sierra D. Luchien

Don’t Judge a Book by Its Cover by Sierra D. Luchien

A scared woman is afraid to live for herself because she’s caught up in the street life and issues with gangs, men, money and abuse. Little did she know she would change her life.

A social worker comes into the picture. She takes Sierra’s siblings out of school, and says she is going to help the family turn things around. But was it a deal with the devil?

That day caused a domino effect, leading to overall depression with underlining pain that was covered with material things and a false pretense. Nothing would stop Sierra not getting raped, stabbed, shot. But she was a runner that ultimately ran right into God as her savior. Purchase at https://bit.ly/4d7xlm1.

Building Wealth Through Rental Properties by Dr. Amit Sachdeo

Building Wealth Through Rental Properties by Dr. Amit Sachdeo

In the ever-evolving landscape of investment opportunities, real estate stands out as a powerful wealth-building tool that has stood the test of time. If you are completely new to rental property investing, this book serves as a comprehensive roadmap to mastering the exciting world of real estate investing.

Packed with practical advice and actionable strategies, this handbook covers everything novice investors need to build a successful rental property portfolio from the ground up. Each chapter is crafted to empower readers with the knowledge, strategies, and confidence needed to unlock the wealth-building potential of real estate. Inside, readers will find the motivation to transform aspirations of wealth and prosperity into an abundant reality of financial freedom.

Key steps include: how to identify lucrative rental properties, optimal financing methods for investing in rental properties, tips for effective property management, real-life case studies, and more. Purchase at www.sachdeo.com/shop.

- As every adult knows, Halloween is not just for kids. Grown-ups may not be out ringing the neighbors’ doorbells, but that doesn’t mean they won’t be having fun.

- As every adult knows, Halloween is not just for kids. Grown-ups may not be out ringing the neighbors’ doorbells, but that doesn’t mean they won’t be having fun. -

-  Sicilian Avengers (Books One and Two) by Luigi Natoli

Sicilian Avengers (Books One and Two) by Luigi Natoli The Time Keepers by Alyson Richman

The Time Keepers by Alyson Richman The Coat Check Girl by Laura Buchwald

The Coat Check Girl by Laura Buchwald Book of the Month by Jennifer Probst

Book of the Month by Jennifer Probst

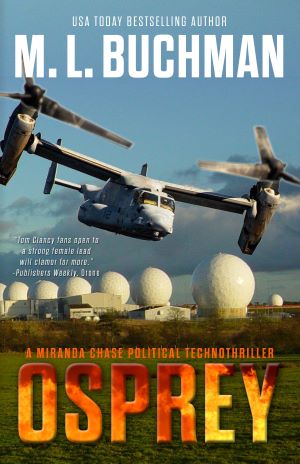

He’s written more than 70 books and is drawing heavy praise for his recurring female protagonist, an autistic who made herself into a genius air-crash investigator. In Miranda Chase, author M.L. Buchman has given readers a most compelling lead character in his fast-growing series of political technothrillers.

He’s written more than 70 books and is drawing heavy praise for his recurring female protagonist, an autistic who made herself into a genius air-crash investigator. In Miranda Chase, author M.L. Buchman has given readers a most compelling lead character in his fast-growing series of political technothrillers.

OSPREY follows the recent release of Buchman’s NIGHTWATCH, another Miranda Chase political technothriller in which a Chinese freighter is attacked and a sabotaged passenger jet crashes in Quebec. And high overhead, an E-4B Nightwatch, America’s fortress-in-the-sky, sees all. With nations shifting to high alert, Miranda lands once more in the midst of the fray.

OSPREY follows the recent release of Buchman’s NIGHTWATCH, another Miranda Chase political technothriller in which a Chinese freighter is attacked and a sabotaged passenger jet crashes in Quebec. And high overhead, an E-4B Nightwatch, America’s fortress-in-the-sky, sees all. With nations shifting to high alert, Miranda lands once more in the midst of the fray.